A crucial element of Nashville’s transit improvement plan — the proposed taxation structure — has been identified. Mayor Freddie O’Connell looks to be homing in on just one tax to fund the transit overhaul: a half-cent sales tax surcharge.

The plan sits at the center of Nashville’s upcoming referendum in November. Thus far, O’Connell has refrained from getting too into the specifics while he seeks input from two advisory committees and the public. He plans to submit a completed proposal for a financial audit by the end of the month.

Proposed sales tax increase

The mayor’s transportation advisor Michael Briggs, WeGo CEO Steve Bland and transit consultants presented the sales tax surcharge to the Technical Advisory Committee team Wednesday.

“Why the sales tax surcharge only? It is the highest revenue potential option. And by highest, I mean significantly higher than the other five surcharges available,” Amanda Vandegrift of InfraStrategies, an Atlanta-based transit financing consultant hired by Metro, told the committee. “It really makes a lot of sense to focus in on that one source rather than a package of smaller sources.”

Currently, Davidson County has a sales tax rate of 9.25%. A half-cent increase would raise this rate to 9.75%.

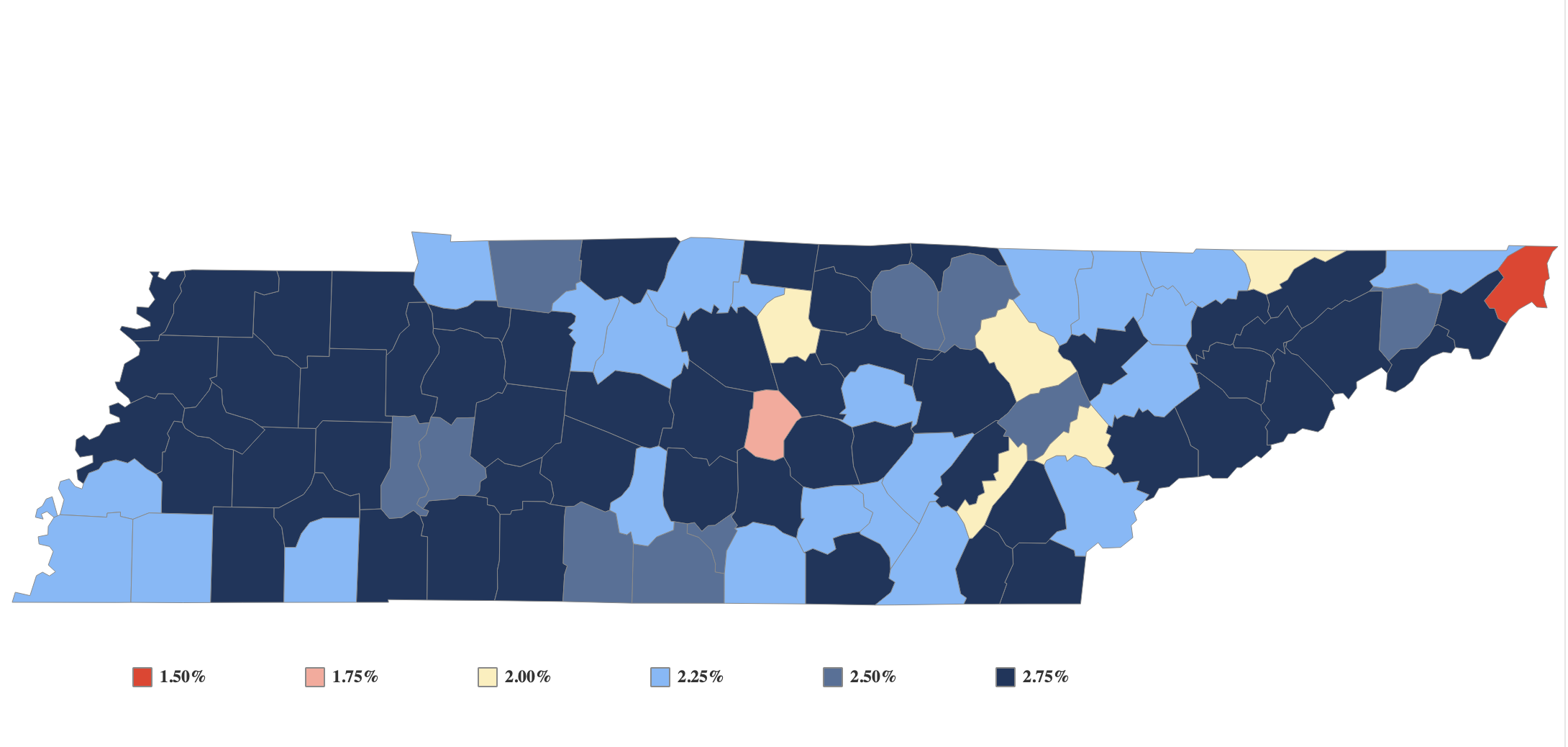

The bulk of the sales tax goes to the state: Tennessee’s state rate is 7%. The remaining amount is left to the determination of the county, though it cannot exceed 2.75%.

The majority of Nashville’s surrounding counties — including Robertson, Rutherford, Williamson and Wilson counties — are already at the 9.75% rate. Only Cheatham and Sumner are not.

In addition to the revenue potential, Vandegrift outlined the advantages of a sales tax surcharge:

- a sales tax is relatively predictable, with a strong growth rate

- nationally, a sales tax is the most common local funding source for transit

- a sales tax offers the opportunity to shift some of the burden to visitors from outside the county — Vandegrift estimates 60% of the sales tax surcharge would be paid by non-Davidson residents — like tourists and residents of surrounding counties.

Other taxation options

Under the state’s IMPROVE Act, there are six taxation options to fund transit.

- Sales tax

- Hotel/motel tax

- Business privilege tax

- Residential development fee

- Local car rental tax

- Motor vehicle/wheel tax

O’Connell has indicated that last year’s deal to finance a new Titans stadium has ruled out usage of the hotel/motel tax.

Drawing upon these other options — which could be used in conjunction with a sales tax — is possible. But, on Wednesday, Vandegrift wondered if it would be worth the risk.

“It’s really to me a question of do you do sales surcharge by itself, or do you do sales surcharge and maybe add one of these?” Vandegrift said. “But then is the juice worth the squeeze? My assessment was it wasn’t.”

In 2018, the last time Nashville attempted a transit referendum, the $5.4 billion proposal would have been financed through a combination of four different tax surcharges — a sticking point for some opponents.

To avoid the 2018 rejection, O’Connell is working to differentiate his approach. He tells WPLN News that he is looking to create a cost-effective proposal.

“We didn’t we didn’t want to produce an expensive program. We wanted to look at a more right-sized approach for the city, given our growth, growth potential, cost of living and quality of life concerns,” O’Connell says. “I think as a result, some of the revenue intensity is less necessary in this plan.”

Bus rapid transit

One major cost-saving difference is the new plan’s lack of rail. The 2018 proposal would have funded 26 miles of light rail, which can cost around $200 million per mile.

O’Connell’s proposal won’t likely include light rail. Instead, the proposal will feature Bus Rapid Transit (or BRT), a high-capacity type of bus system, operated on dedicated bus lanes. BRT costs around $50 million per mile.

On Wednesday, map proposals were presented to the Technical Advisory Committee. These showed dedicated BRT lanes along four corridors: Dickerson Pike, Gallatin Pike, Murfreesboro Pike and Nolensville Pike.

North Nashville, Charlotte Pike and West End have been designated as bus “priority areas.” West End may be elevated to a BRT lane.

Federal funding

The proposal wouldn’t be funded solely through the sales tax increase. Establishing a pool of local transit money through the sales tax would allow access to federal dollars, that, so far, have been off limits without a local match.

But time is ticking. Hundreds of millions of dollars are available for fixed-route, high-capacity transit expansion through the Bipartisan Infrastructure Law. Passed by President Biden in 2021, the law expires in 2026.

“Right now, you have been doing really the most you can with what you have been given to bring down federal dollars and matching dollars. But with a dedicated long-term revenue stream, you open the door [for federal investment],” Vandegrift says. “We really only have a few more years, assuming it maybe kicks down the road a few more years, to compete for and bring hundreds of millions of dollars of federal support into Nashville.”