Tennessee faces one of the highest potential job losses in the nation under proposed federal legislation.

President Donald Trump’s “big beautiful bill” contains numerous policy changes that will affect a broad range of American life — including a repeal of clean energy tax credits that were part of a climate package, called the Inflation Reduction Act, passed in 2022.

In the past three years, these tax credits helped spur billions of dollars in investments for clean energy, thousands of new jobs and hundreds of millions of dollars in economic activity.

More: Trump megabill could make Tennessee electricity prices surge as early as next year | WPLN News

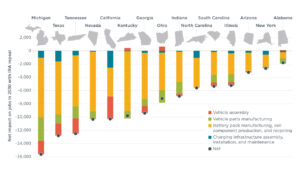

With the tax credits under threat, Tennessee has the third-highest number of jobs at risk in the electric vehicle manufacturing sector in the nation. About 12,600 jobs and $4.5 billion in known EV-related investments are threatened, according to an analysis by the International Council on Clean Transportation.

Courtesy International Council on Clean Transportation

Courtesy International Council on Clean Transportation About 12,600 jobs and $4.5 billion in electric vehicle manufacturing investments are threatened under President Donald Trump’s proposed tax bill, according to the International Council on Clean Energy.

Analyses by universities and energy research groups have been consistent in finding that the proposed bill would raise the price of energy, create more pollution and threaten manufacturing jobs.

An analysis by Energy Innovation found that repealing clean energy tax credits will reduce Tennessee’s GDP by $1.8 billion in 2030 and raise emissions equivalent to the annual climate pollution of one coal-fired power plant. The group found that the repeal will cost about 15,000 jobs in the state by 2035.

In terms of jobs, manufacturing is Tennessee’s second-largest industry, according to the state’s labor office.

Sen. Bill Hagerty, R-Tenn., said his main hope for the legislation is investment and jobs.

“The main interest I have is making certain that we stimulate more capital investment in America because more capital investment will beget more jobs,” Hagerty said during an interview with Bloomberg News earlier this month.

Hagerty, as well as Sen. Marsha Blackburn, R-Tenn., voted no on the IRA in 2022.

Other job sectors beyond manufacturing could also be impacted. The IRA includes home energy tax credits for insulation, heat pumps, energy efficient windows, solar and more — which has spurred a lot of work.

In Tennessee, more than 45,000 Tennessee households used these tax credits in 2023, generating $473 million in economic activity and supporting about 1,700 jobs in the state, according to an analysis by Rewiring America.