Many Nashville homeowners are bracing for higher property tax bills this year.

There are two programs offered by Metro that can help alleviate the burden for some homeowners. The programs — tax freeze and tax relief — are limited to certain populations and are income restricted. This year, those income limits have been raised, expanding the pool of who can qualify.

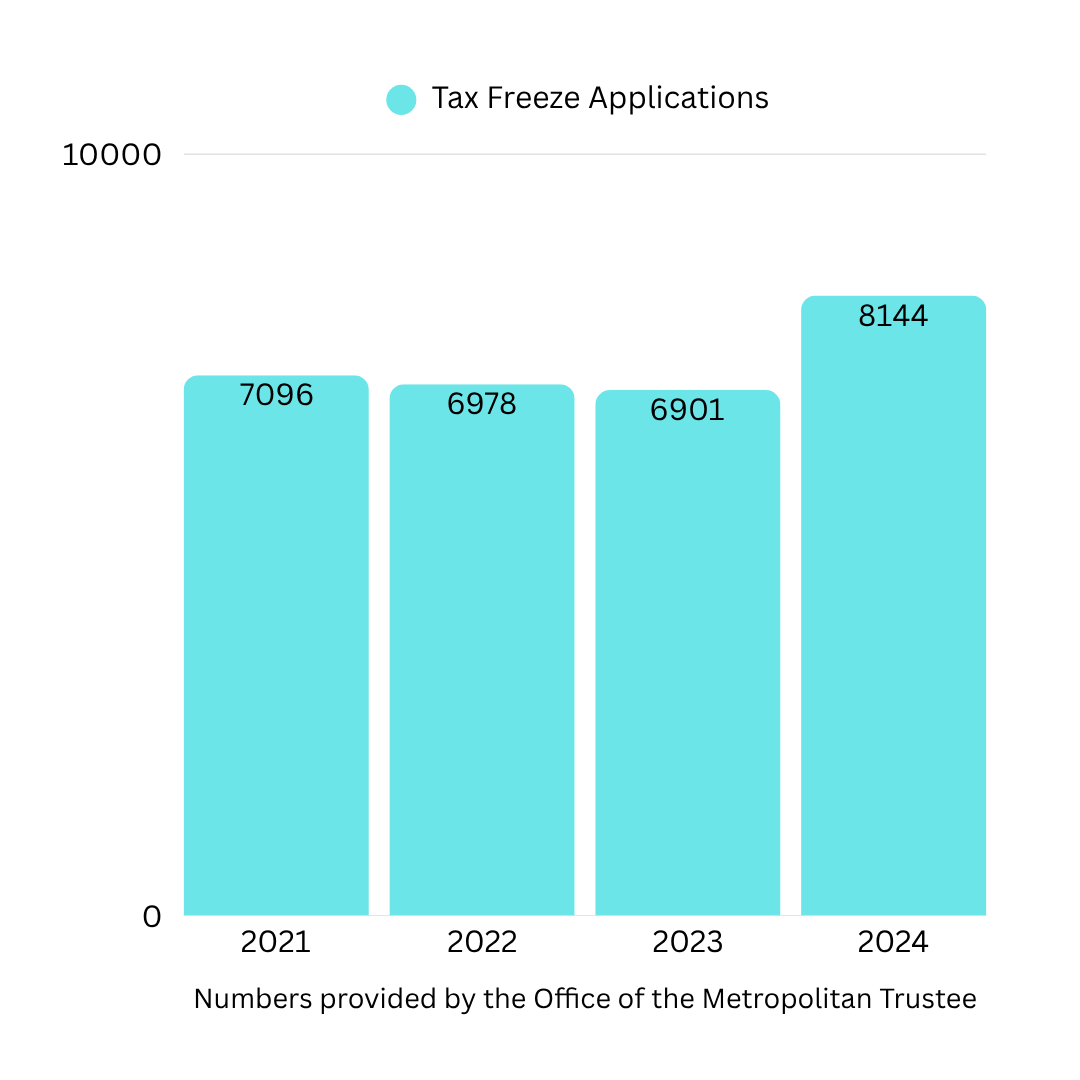

Tax freeze is largely what it sounds like: the program “freezes” the amount of property taxes due for the year that the homeowner qualifies. So, even if the tax rate goes up, the bill does not.

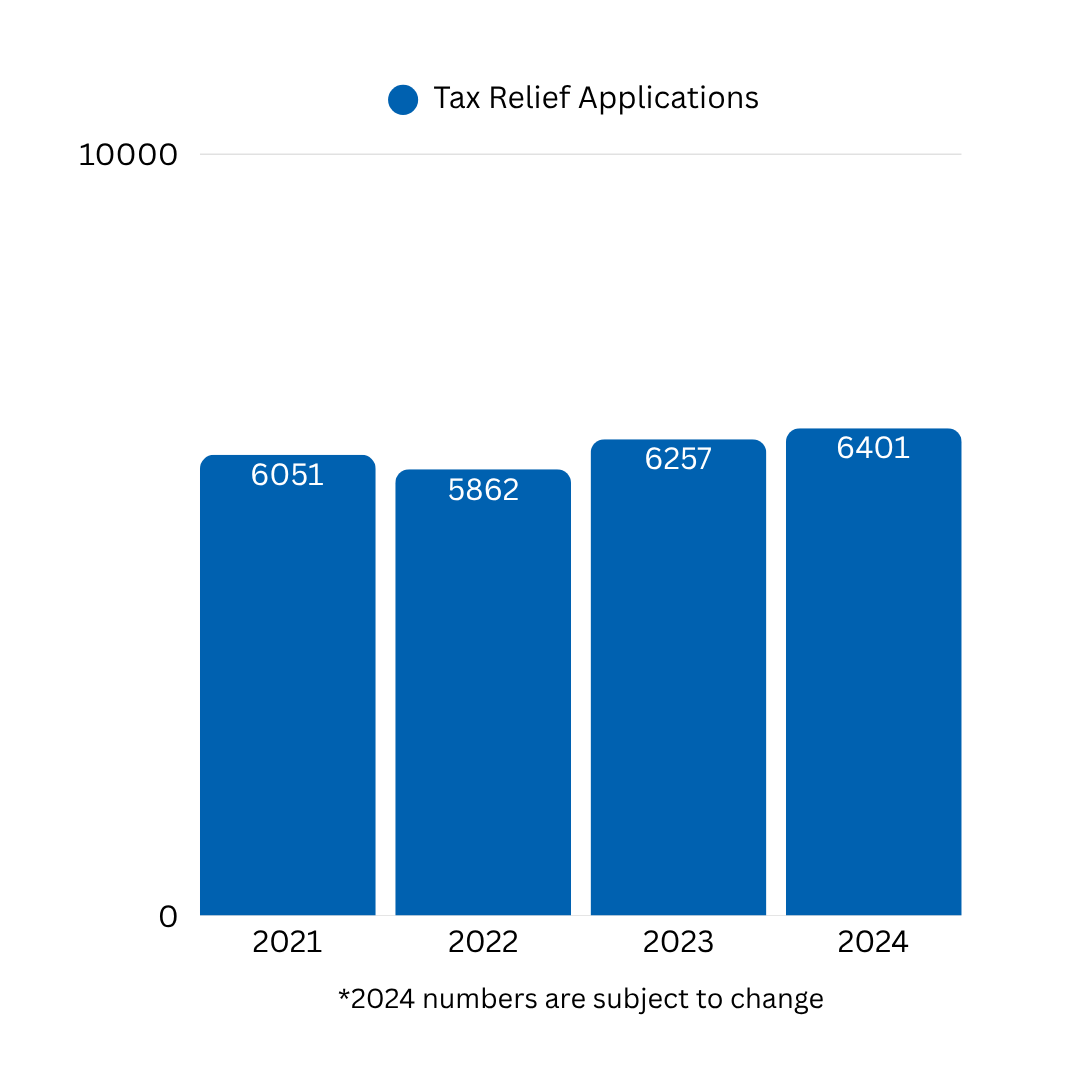

Tax relief offers more support — it reimburses some, or all, of paid property taxes, and helps protect people from being priced out.

These programs are only are only available to some: tax freeze is for seniors, aged 65 and older. Tax relief is also open to seniors, plus people who are disabled or who are military veterans or a surviving spouse.

And both programs are further restricted by income. Tax freeze is now limited to people who make $61,920 or less. That’s up from the $60,000 cap in 2024. Tax relief is limited to people who make $37,530 or less, up from $36,370 last year.

For tax freeze, the increase is modest compared to the previous year. The tax freeze cap jumped by more than $12,000 dollars between 2023 and 2024. Last year saw more applications for the program, although not a significant increase.

The application window will open this fall. At that time, interested homeowners can schedule an appointment online at the Office of the Metropolitan Trustee webpage.