Tennessee has projected how much it expects its revenues to increase in the next couple of years. And in keeping with recent trends, they’re staying fairly conservative.

Monday, the State Funding Board approved predictions that total tax revenues will rise between about 6.8% and 7.3% this fiscal year. For the budget year beginning next summer, the board approved a projected growth rate between 1.4% and 2.3%.

Those estimates inform the overall size of the state’s budget. The governor and legislature will use them to amend and craft spending plans.

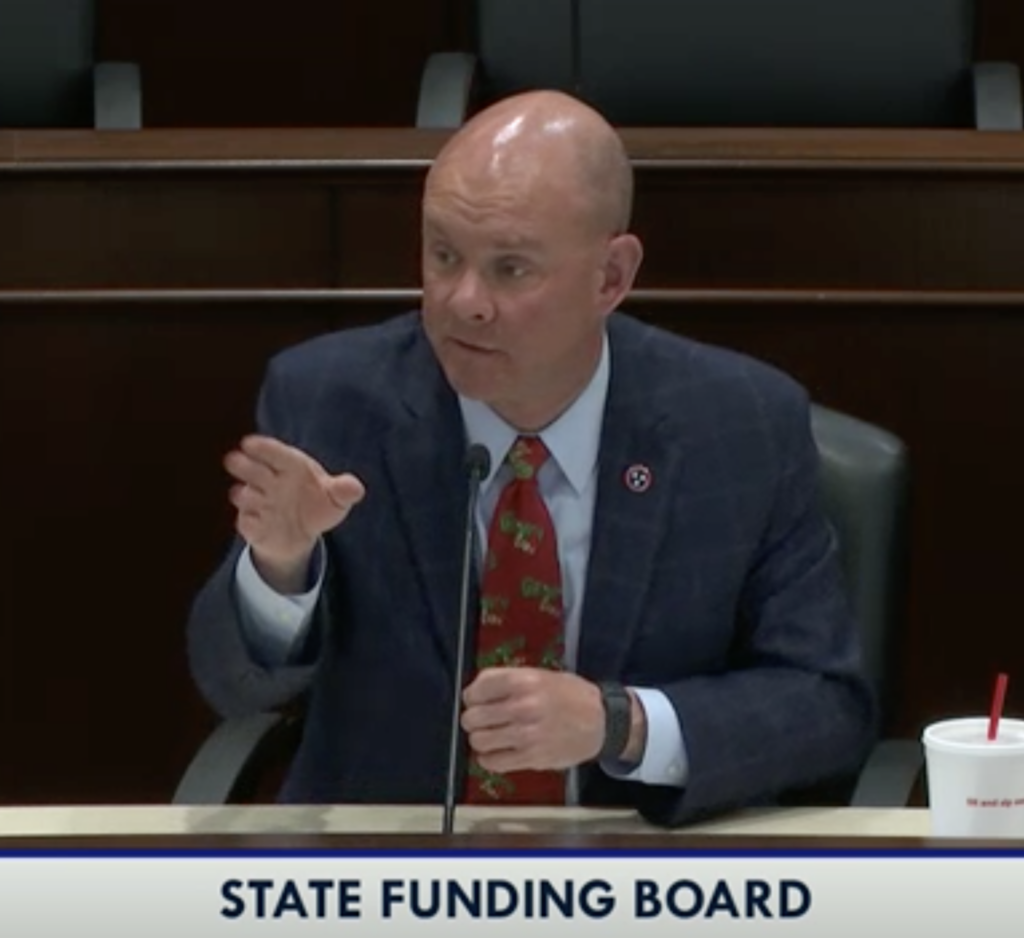

Tennessee Comptroller Jason Mumpower says these kinds of careful estimates have helped Tennessee become one of the most fiscally stable states in the country.

“That is not something that just happened. That’s something that’s been achieved through diligence and discipline and conservative financial management.”

Uncertainty about the economy lingers, as do concerns about inflation and interest rates.

Conservative predictions mean that if there is an economic slowdown, the state is less likely to have to make emergency cuts. But in recent years, revenues have massively outperformed the state’s expectations. Tennessee has collected billions in surplus tax dollars.

For example, the state predicted about a 7% increase in revenue around this time last year. In reality, the state’s revenues grew more than 16%. Tennessee collected more than $4.5 billion more than it budgeted during that fiscal year.

The state legislature allocated some of that money to infrastructure and capital projects. They put another chunk into the Rainy Day Fund, which is only supposed to be tapped into as a last resort. A large slice of that money can’t be touched until the General Assembly finalizes its next spending plan in the spring.

In the first few months of this fiscal year, Tennessee has collected more than half a billion dollars more than it budgeted.