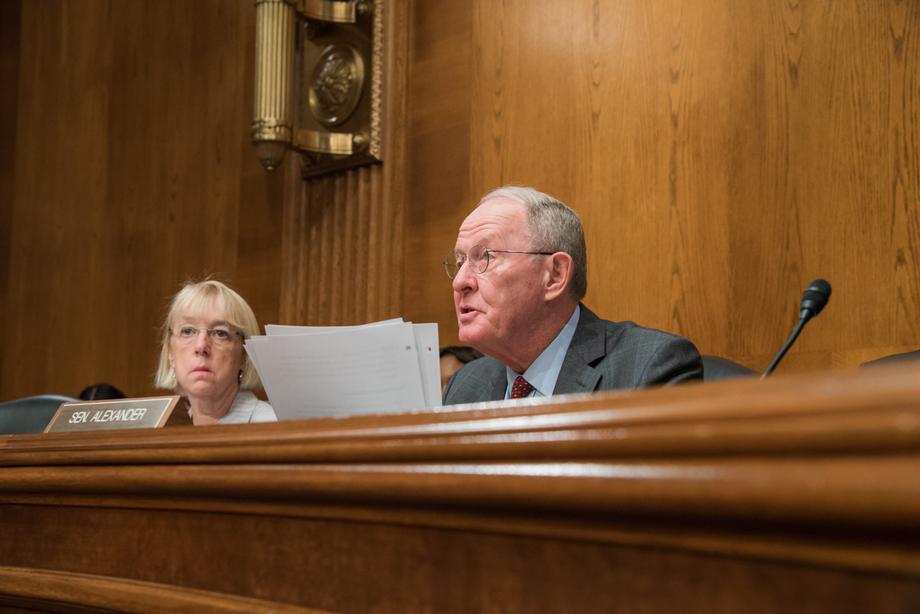

Air ambulance companies are fighting Tennessee Sen. Lamar Alexander’s effort to ban surprise billing. They argue that limiting what they charge would hurt access to lifesaving transportation in rural areas like Tennessee, where nearly a dozen outlying hospitals have closed in recent years.

Nearly two-thirds of air ambulance rides are out-of-network for the patient, according to the

Government Accountability Office. That means an insurer may cover only a fraction of the cost, leaving patients with the balance. That’s what’s often called a “surprise medical bill.”

Seth Myers is the CEO of AirEvac, one of the largest air ambulance companies, and acknowledges that the industry depends on charging patients with private insurance much higher rates. He says government insurance programs like Medicare and Medicaid don’t cover the cost.

“It’s a cost shift, really like the rest of health care is,” he says. “I’m not overcharging. I’m charging what I need to be able to make up the losses for people who really do have the need, but the government or they are unable to pay.”

Under Alexander’s

proposal to end surprise billing, patients would never be on the hook for more than their insurance company is willing to pay for an air ambulance ride. And health plans typically try not to pay much more than the government does.

But Myers says some large insurers refuse to negotiate acceptable in-network rates. He warns that a surprise bill ban could lead to the closure of more helicopter bases, especially in outlying areas where they’re increasingly needed as rural hospitals close. AirEvac has closed three of its outposts in recent years.

“We are that safety net,” Myers says, while also accepting the need for some changes. “We believe the patient needs to be taken out of the middle between the provider and the insurer.”

The industry prefers

surprise billing legislation supported by Tennessee Sen. Marsha Blackburn, which does not specifically target air ambulance service.