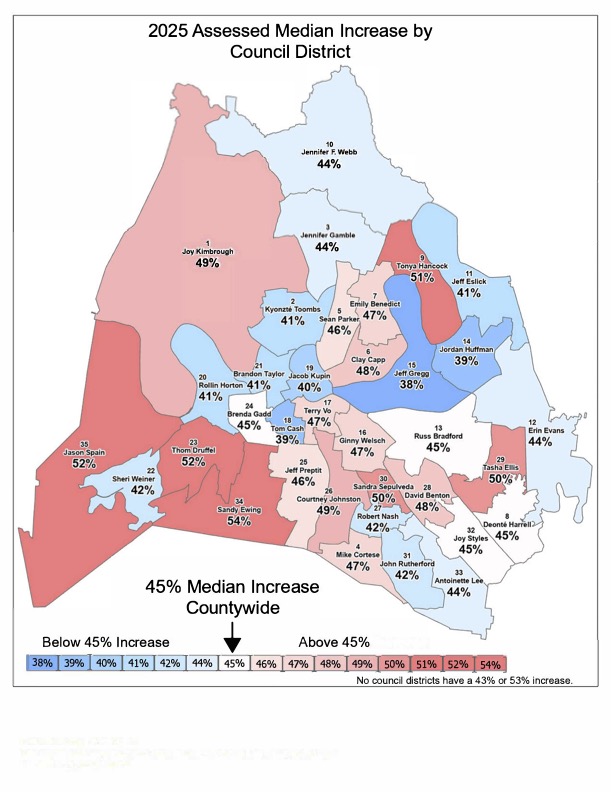

Nashville’s property values are up substantially in the latest countywide property reappraisal. The average increase across Davidson County was 45% since the last reappraisal four years ago.

More: Here’s what Nashville’s property reassessment means for your tax bills — and city revenues.

Property owners should watch for their individual valuations via mail.

Starting Monday, owners are allowed to appeal, and the assessor notes that the window to do so is longer this year — extending until May 9. An online review can be requested online at www.padctn.org or you can call 615-862-6059.

The deadline to request an informal review is May 9 at 4 p.m. Property owners will be notified of the review findings no later than June 6.

The reappraisal will trigger an adjustment to Nashville’s property tax rate. By law, the city cannot take in a windfall of tax dollars because of the reassessment. Then it will be up to the mayor and Metro Council to consider adjusting the rate, and a property tax increase has not been ruled out by officials.

When grouped and averaged by council district, property values increased between 38% and 54% according to figures from the property assessor.

Courtesy Assessor of Property

Courtesy Assessor of PropertyThis heat map shows the average property value change by Metro Council district.