A Nashville nonprofit that helps vulnerable youth has added basic personal finance to its list of classes. Teens at the Oasis Center are taught topics like opening a bank account and the pros and cons of investing.

This summer, four students from the first class also tried to help their peers learn how to budget.

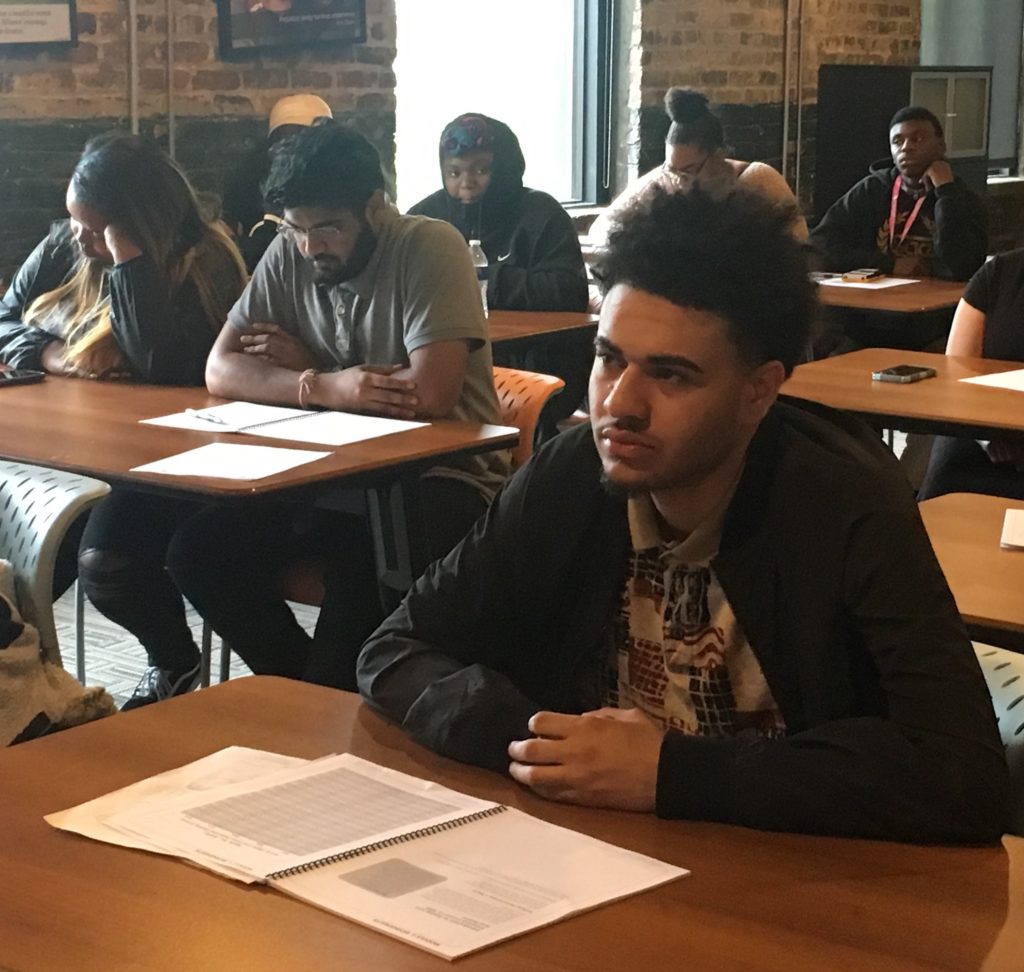

Derek Nicholson was one of the four. Nicholson grew up in a public housing complex close to the Oasis Center and says financial planning was not something his family ever discussed. So the 18-year-old, who’s also been on the Mayor’s Youth Council, jumped at the chance to sign up for the new class.

Nicholson said, without the class, he wouldn’t know what he now knows.

“A big goal of mine is financial freedom,” he said. “That’s why I’m here.”

That

freedom comes from financial literacy, said Lethia Swett Mann of First Tennessee Bank. She was one of the teachers of the six-part course that was

brought to Oasis by Brandon Hill, the Center’s community engagement coordinator. Hill said attaining financial freedom, however, isn’t always straightforward. He’s seen some in the class really struggle to understand just the

concept

of expendable income.

“Those are the types of big ‘Aha!’ moments that come out of these sessions,” said Hill. “I wish people could see. I think it would change the way we think about how we support young people and the ways we go about doing these types of initiatives.”

Another young person who said she was changed by the class is Kailena Reinhard. The recent high school graduate said learning to open her

own

savings account, and not rely on her family for money, was a big relief.

Reinhard

said, in her home, the question of the day was: ” ‘What are we having for breakfast? … Because no one went grocery shopping.’ I just feel like I grew as a person because now I know so much about financials and how to work a proper budget, and it comes in handy for applying for scholarships.”

Reinhard and Nicholson, who head to Austin Peay State University this fall, both had summer jobs through Opportunity Now, a program for Nashville youth run by the mayor’s office. And they were among four recruited from the Oasis class to also work as financial peer coaches

.

They were paired up with even younger members of another Opportunity Now jobs program. They would check in to see the kids were putting aside five percent of their paychecks into savings, as recommended — and if not, what was getting in the way.

Before she started calling the kids assigned to her, Reinhard said she liked how adults were removed from this dynamic, which is the point. She think teens can feel that adults trying to teach them about budgeting could be seen pressure: “

Some people can find it kind of annoying. So it first comes from someone who’s more in your age range, it can be better.”

But the reality ended up being a little different. Reinhard and Nicholson were initially shocked to find out the younger kids consider them

adults, calling them ma’am and sir.

They did make more headway after tweaking the script they were supposed to use.

This is from the original: “

Throughout this experience I’ll be contacting you to provide you with information and encouragement that you need to reach your goals that you have established in your first counseling session.”

Definitely not written by someone their age.

But Nicholson said many of the young teens he talked to eventually did grasp the value of long-term

budgeting. Though he thinks the most important part of financial coaching is simply providing reality checks. Like to one girl, who initially wanted to save just $50 for the entire summer, and said she was going to use it for clothes and shoes.

Nicholson said, “I told her, in reality a pair of shoes are $50, they’re more than $50!”

But, he said, that’s how financial freedom grows, from the small-scale to the large. The more

Nicholson

knows, the bigger his goals are getting.

One of his first after college, he said, is to create more programs that help youth like himself rise from poverty.