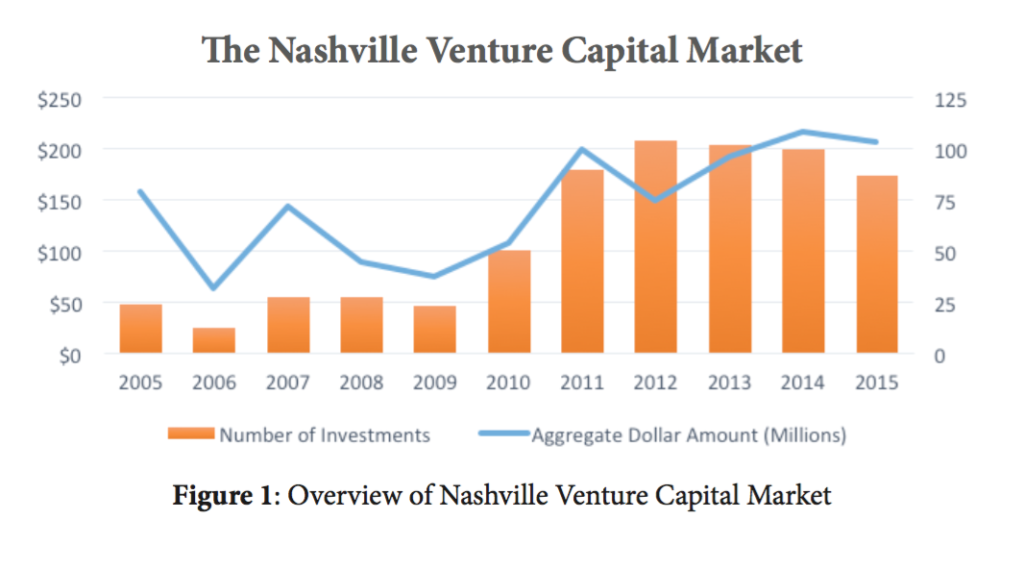

There’s more venture capital money floating around Nashville, and most of it is still going into the health care business. The city’s investors and health care executives have compiled a report that finds in the last 10 years, $1.6 billion has been poured into local startups, 60 percent of that went into health care.

These are companies that have moved beyond angel investors or getting help from friends and family. According to the Nashville Capital Network and the Nashville Health Care Council — who jointly produced the

report — a total of 300 firms were backed by venture money between 2005 and 2015.

More:

Read the full venture capital report.

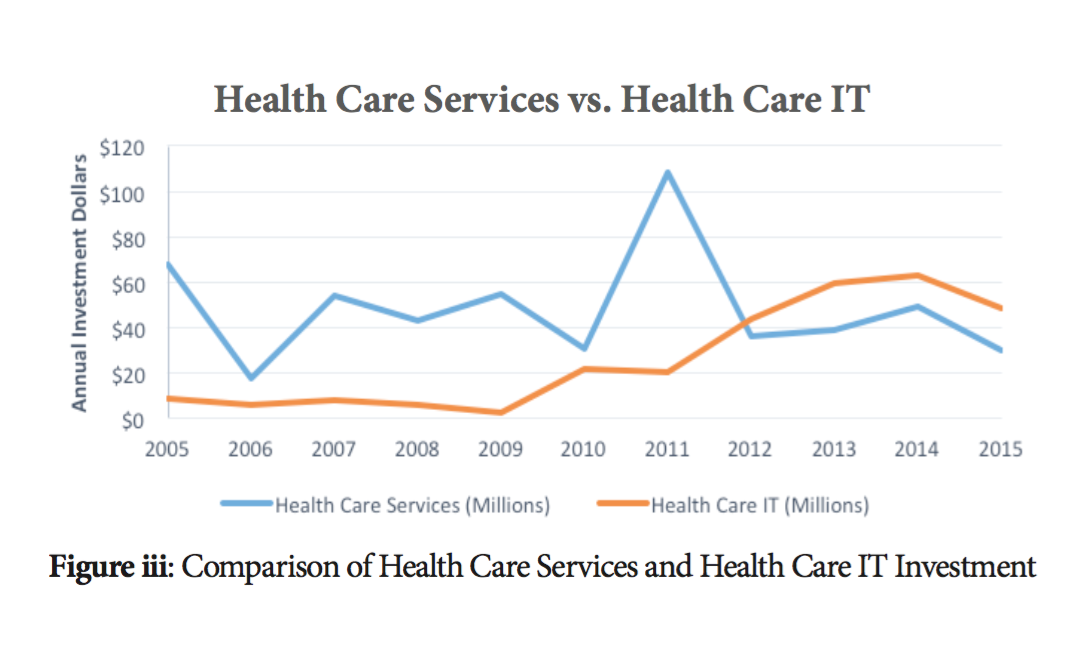

More and more money has been going specifically to health care IT — far outpacing the national average. There’s now more investment heading toward the tech side of health care than even Nashville’s traditional services industry, like hospital chains and surgery centers.

While this venture capital report shows there’s been a lot of growth, most of the money is still coming from local sources. It points out that early-stage companies are having trouble getting interest from bigger venture capital firms from out of town.

“These trends show an exciting opportunity for Nashville investors,” NCN executive director Sid Chambless said in a statement. “Early success often increases a company’s capital requirements beyond the scope of individual angel investors. Therefore, local venture resources focusing on the early-stage rounds are necessary to maintain a healthy capital continuum in Nashville.”