Many Tennesseans could end up paying more for health insurance next year, despite a sizable drop in average rates on the individual marketplace. That’s because the subsidies are also shrinking — often more than the monthly premiums.

There’s nothing simple about calculating how much someone will pay for Affordable Care Act insurance, which is why so-called navigators have been available for in-person help (

though less so this year). So Jennifer Tolbert, director of state health reform at the Kaiser Family Foundation, recommends everyone shop around rather than just keeping their current plan.

“Because things are changing so much,” she says. “The plan that they are in now, which may have been the most affordable one for them last year, may suddenly no longer be the most affordable plan option.”

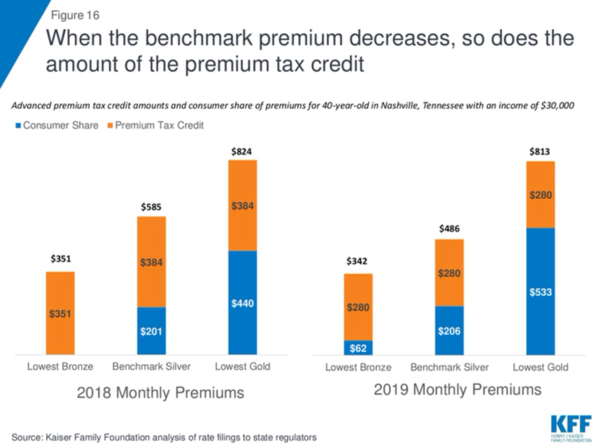

The unpredictable fluxuation comes from the peculiar way subsidies are calculated. They’re based on the cost of the second cheapest silver level plan. And since those mid-level plans in Tennessee reduced even more than bronze and gold coverage, the subsidies don’t go quite as far.

For example, a 40-year-old man making 30,000 a year will no longer have a free option and would actually pay considerably more for a gold plan.

In 2018, the opposite was true. And despite much higher prices on Tennessee’s insurance exchange for 2018,

many people were pleasantly surprised that they ended up spending less out of pocket each month.

Roughly 90 percent of Tennesseans who buy individual coverage qualify for some kind of subsidy, but those who don’t will directly benefit from the reduced premiums. ‘

But even the 2019 rates, which are

down 10 to 20 percent, still won’t make coverage affordable for all. Premiums nearly tripled in the first few years of the Affordable Care Act. Tennessee went from having some of the cheapest plans to some of the most expensive.

As a result, the uninsured rate has continued to creep back up since 2014. This week, the Boyd Center at the University of Tennessee released its

annual survey, showing a 6.7 percent uninsured rate, up from 6.1 percent a year prior. And increasingly, respondents say they’re not buying coverage because it’s not affordable enough.

Open enrollment begins Thursday and runs through December 15.