Nashville’s booming growth and high demand for real estate have pushed property values substantially higher since 2017 and will have implications for tax bills, according to figures shared Thursday by the property assessor in Davidson County.

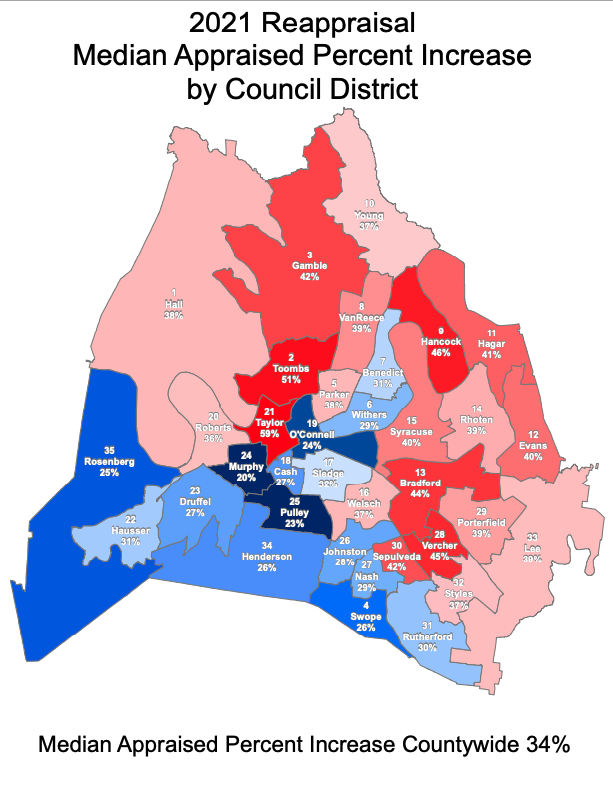

Property owners should see their specific reappraisals arriving by mail soon. When grouped by Nashville’s 35 Metro Council districts, the median increases ranged from 20% to 59% (map below).

The countywide median increase was 34.05%. That’s a key figure that will help property owners understand how their taxes might change. Anyone with a valuation that increased more than that will likely pay higher property taxes; those below the median should pay less. That’s because Tennessee law says the city must take in the same amount of revenue — and not collect a tax windfall — when assessors find that values have risen.

Generally, as property values rise, the tax rate tends to be adjusted down. Last year, separate from property valuations, the mayor and the Metro Council approved a rate increase of roughly 34%.

Conversation has been buzzing about the reappraisal and the tax rate since Mayor John Cooper hinted at the numbers on Friday. After releasing her figures at 1 p.m. Thursday, Property Assessor Vivian Wilhoite was scheduled to make a 5 p.m. presentation to the Metro Council.

“[We] have had a front seat to the real estate boom occurring in our community,” Wilhoite wrote in her release.

Courtesy of Davidson County Property Assessor

Courtesy of Davidson County Property Assessor This Nashville heat map shows the median property value increases by Metro Council district.

Like four years ago, Wilhoite was quick to note that owners can appeal if they disagree with the valuation. That process is detailed online at www.padctn.org.

An “informal review” can be requested by calling 615-862-6059. The deadline to make that ask is 4 p.m. on May 21, with results returned to owners by June 11.

Informal reviews are not required for an owner to seek a more rigorous appeal hearing with the Metropolitan Board of Equalization. Those hearings will happen between May 24 and June 25 and can be scheduled by calling 615-862-6059.

This is a developing story.